Evaluation of Risks and Updating the Register of Risks

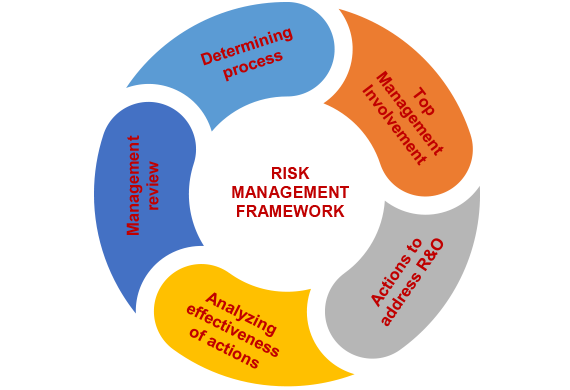

Risks have been filtered by the following table which levels the probability and consequence of each activity. If the multiplication of the probability and consequence are above the scales of 16, it is considered that the risk is high and it has to be controlled by HODs monthly review.

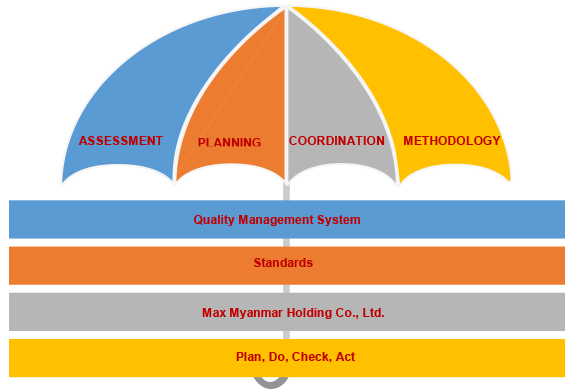

The QMS Committee shall identify risks, opportunities and evaluate with the aid of the evaluation criteria method as above to cover the process/ activity where the aspect is identified, a brief description of the aspect, the expected to result from the risk, score of the impacts based on the evaluation criteria, the control mechanism for each risk; present control, reduce/ remove actions, responsible persons and opportunities.

All employees of Max Energy have some responsibility for internal control as part of their accountability for achieving objectives. They, collectively, should have the necessary knowledge, skills, information, and authority to establish, operate and monitor the system of internal control. This will require an understanding of the company, its objectives, the industries and markets in which it operates, and the risks it faces.